New Zealand: Calls For Tobacco-Style Alcohol Tax

Alcohol Healthwatch, a team of professionals dedicated to reducing and preventing alcohol-related harm in Aotearoa New Zealand, calls for tobacco-style alcohol taxes.

Dr Nicki Jackson says alcohol is the most harmful drug in New Zealand society, and alcohol taxation and other measures are all backed by evidence showing they are cost-effective in reducing and preventing alcohol-related harm.

When it’s accessible and it’s next to your bread and your milk, you don’t really consider it as a harmful drug,” Dr Jackson explained.

All alcohol is just too cheap in this country, and we would like to see excise taxes, similar to what has happened in tobacco. These are really cost effective approaches that could be done overnight, and we’re just waiting for the action really.”

My family is paying the equivalent of $6,000 every year for alcohol related harm. Wouldn’t I rather see that money spent on more teachers, medication?”

The tobacco excise tax contributes almost $2 billion a year in New Zealand.

Health boards across the country including Auckland and Counties Manukau are calling for price hikes, restrictions on advertising and sponsorship, and an increase in the purchasing age.

Alcohol is not an ordinary commodity. It is an intoxicant, toxin, and addictive psychotropic drug,” the DHB Auckland said, per NZ Herald.

Alcohol has been normalised and largely accepted by society, and causes more harm than any other drug in society.”

Pervasive harm, urgent need for evidence-based action

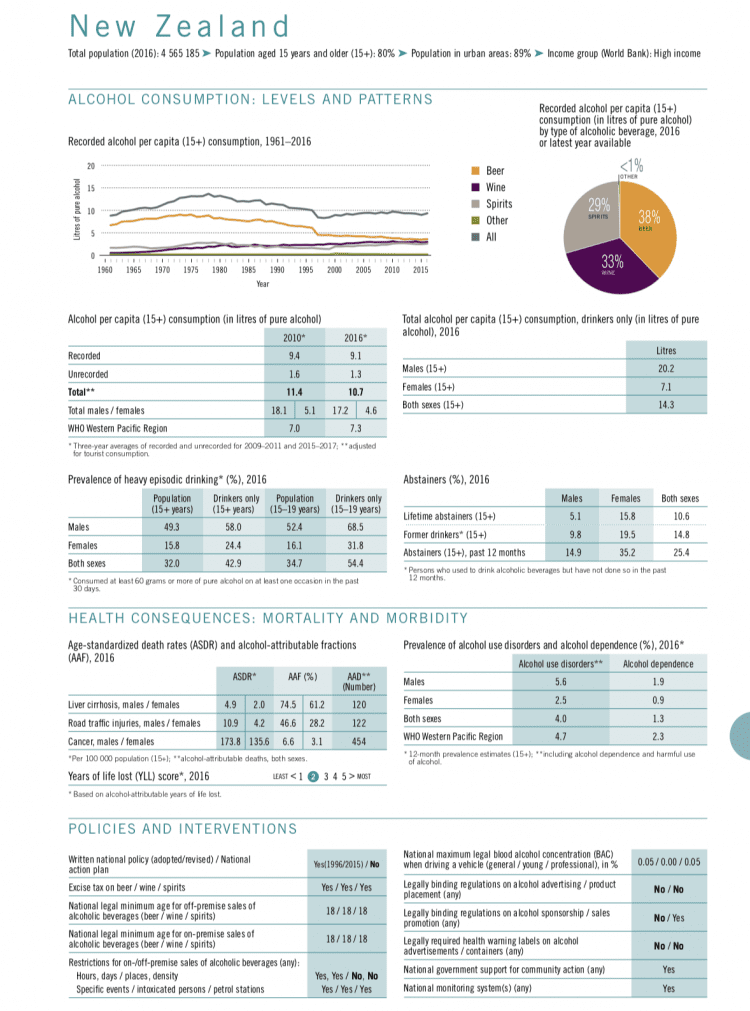

World Health Organization data shows that New Zealand has a massive alcohol problem.

- Total alcohol per capita consumption is higher than the regional average, with 10.7 liters.

- Among alcohol users alone, per capita alcohol use amounts to 14.3 liters, and for males only it is a shocking 20.2 liters.

- More than half of all alcohol users engage in heavy episodic alcohol use.

- Since 2015, there’s no new national alcohol policy.

Alcohol taxation – a best buy alcohol policy solution

In contrast to Big Alcohol claims, alcohol taxation is endorsed by the World Health Organization as a best buy measure in reducing and preventing alcohol-related harm.

For example, a study of 42 high-, middle- and low-income countries found that raising excise duties on alcohol to at least 40% of the total retail price would increase tax revenue in these countries by 80% to US$ 77 Billion. Expressed as a proportion of total current spending on health, it is low-income countries that have most to gain (additional receipts would amount to 38% of total current spending on health).

Implementation of evidence-based alcohol taxation is also likely to have a net positive effect on employment, as consumers divert their spending on other (healthier) products, services and needs.