Czechia: Plans for Alcohol Tax Increase

The Czech Finance Ministry plans to increase taxes on addiction industries including alcohol. The increased tax will boost tax revenue for the government by 10 billion Czech crowns in 2020.

The proposed tax increases will be for hard liquor (approximately 13% higher), cigarettes (a 10% increase), sports betting (2%) and lotteries and similar games (7%). However, beer and wine would be unaffected by the tax increases.

The government approved the tax increase on alcohol and other addiction industries on May 27, 2019*.

The alcohol industry estimates the proposed tax would increase the price of a half liter bottle of hard alcohol by 9.1 crowns.

Adjusting alcohol tax to inflation

Czech Finance Minister Alena Schiller states the tax increase is to match the salary growth and increase in purchasing power among the average Czech citizen over the past decade. The average wage growth in the Czechia between 2009 and 2018 was 45%, while consumer tax on alcohol was last increased only in 2010.

Currently, treatment for alcohol addiction in the country costs 60 billion crowns.

Both the World Health Organization and the OECD recommend that we do something about alcohol and tobacco consumption, and one of the most effective recommendations is a higher tax,” said Czech Health Minister Adam Vojtech, as per Expats Cz.

Alcohol harm in the Czech Republic

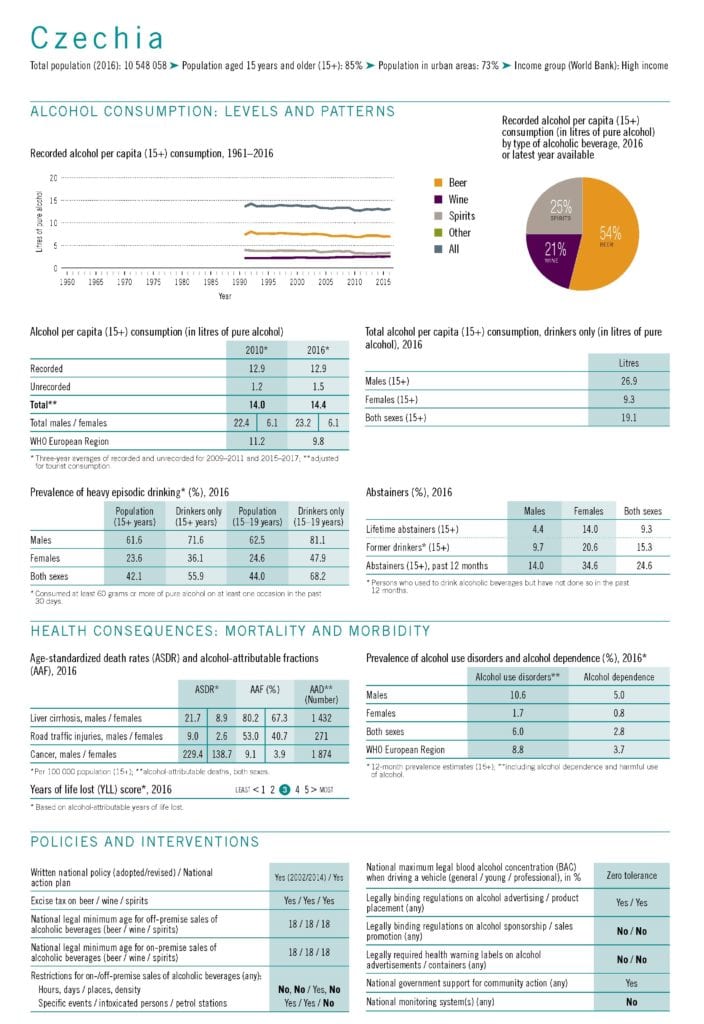

Observing the data reported by WHO it is clear strong policy action such as through the proposed tax hikes are necessary to curtail the pervasive alcohol harm in the Czechia.

Alcohol per capita consumption has increased in the country to staggering 14.4 liters in 2016 which is comparatively above the average for the WHO European region. More than half the alcohol users over 15 years and about two thirds of alcohol using youth between 15 to 19 years binge on alcohol.

When alcohol taxation is implemented effectively by governments it is a tool for sustainable development, as well as reducing alcohol consumption and the resulting harm.

*The information has been updated on May 30, 2019