USA: Senate to Support Major Tax Break for Big Alcohol

A majority of senators in the U.S. Congress are supporting a bill that can make the massive excise tax break permanent for Big Alcohol. It’s good news for Big Alcohol and bad news for public health and safety in the United States.

The bill in question is the 2019 version of the Craft Beverage Modernization and Tax Reform Act (CBMTRA). The legislation seeks to make permanent the two years of tax breaks that alcohol producers and importers received as part of the so called Tax Cuts and Jobs Act, which would expire at the end of 2019.

Big Alcohol is lobbying aggressively to make sure this tax break will become permanent. The bill has already gained support from 28 Democrats, 22 Republicans and one Independent as co-sponsors in the Senate, and 86 Republicans and 70 Democrats in the House of Representatives.

Big Alcohol has no plans to let up on their efforts to push this bill. Alcohol industry lobby groups have joined forces to make sure alcohol policy benefits the industry instead of the people. The Beer Institute, the Brewers Association, the Distilled Spirits Council of the United States (DISCUS), the American Craft Spirits Association, Wine America, the Wine Institute, and the U.S. Association of Cider Makers are the groups working to push the bill.

Big Alcohol lobbying strategies

While they paint a picture of supporting small businesses and local brewers it is obvious the bill would cut taxes for the entire industry. This is even more obvious from a statement made by the The National Beer Wholesalers Association (NBWA), who are also in support of the bill.

NBWA continues to support the brewers’ efforts to maintain a lower federal excise tax for brewers and importers of all sizes,” said Laurie Knight, NBWA executive vice president for government affairs, as per Brewbound.

It is evident Big Alcohol has no intention of limiting tax cuts to small time brewers.

In reality the tax relief over the past two years looked like this:

- The federal excise tax for domestic brewers producing fewer than 2 million barrels annually was reduced from $7 to $3.50 per barrel on the first 60,000 barrels.

- The federal excise tax was cut to $16 per barrel on the first 6 million barrels for all other brewers and beer importers.

- $18 per barrel excise tax for brewers producing more than 6 million barrels.

This is a crucial week for alcohol industry lobbyists. Hundreds of brewers will be descending upon Washington D.C. to members of lobby the Ways and Means and Finance committees, among other lawmakers.

These lobbying efforts are further backed by the Brewers Association (BA). As BA CEO Bob Pease stated recently, BA has made it their top priority to push this bill through and have formed a specific Political Action Committee (PAC) to further their goals.

Big Alcohol policy: profit over health

As Beer Institute (BI) president and CEO Jim McGreevy says what is at stake for the Beer industry is $130 million in annual savings.

So whats at stake for public health?

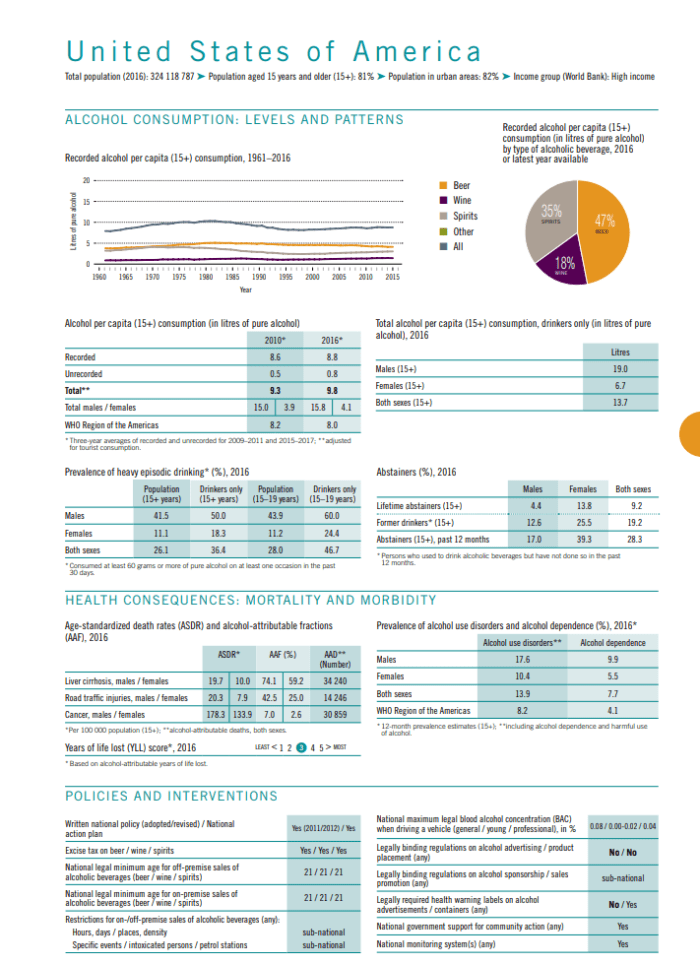

The United States’ per capita alcohol consumption shows an increasing trend and is currently at 9.8 liters which is above the average for the WHO Americas region. Out of all alcohol users, over one third of users above 15 years of age and almost half of youth between 15 to 19 years engage in the harmful habit of binge alcohol use.

Alcohol harm is preventable

Over the past few years, alcohol attributable illnesses have contributed massively to eroding life expectancies in the US. The total number of alcohol-related deaths per year is 88,000 in the U.S.

Decline in life expectancy is political choice: Big Alcohol profits, people’s well-being is not prioritized

At least as far as alcohol policy making is concerned, the increased rate of mortality in the United States is of political making. Law makers are not instituting proven measures that would help prevent and reduce alcohol harm, instead they are eroding existing measures, like with the alcohol tax break.

- Increasing the alcohol tax

The alcohol tax has not been increased since the 1990s in the U.S. As a matter of fact, that means that alcohol has become cheaper. A 2010 review of the research in the American Journal of Public Health revealed strong evidence:Our results suggest that doubling the alcohol tax would reduce alcohol-related mortality by an average of 35%, traffic crash deaths by 11%, sexually transmitted disease by 6%, violence by 2%, and crime by 1.4%.”

- Reducing the number of alcohol outlets

A 2009 review published in the American Journal of Preventive Medicine found that limiting the number of alcohol outlets can reduce alcohol harm. - Put state governments in charge of selling alcohol

A 2014 RAND report concluded that when state governments monopolize alcohol retail, they can keep prices higher, reduce access to youth, and reduce overall levels of use and associated harm.

State alcohol policies are known to have a positive effect on binge alcohol use. Science has found stronger policy action reduces this harmful habit.

State Alcohol Policies, Taxes, and Availability as Predictors of Bingeing on Alcohol

The health consequences of alcohol use are significant and growing in the USA.

Alcohol is attributed to:

- 34,000+ deaths due to Liver Cirrohsis

- 30,000+ deaths due to Cancer

- 14,000+ deaths due to road traffic injury

- Alcoholic fatty liver disease is a growing health concern for the USA.

WHO reports 13.9% of Americans suffer from alcohol use disorders. This statistic is significantly above the average of the region.

So now the government must ask the question, what’s more important, public health or the interests of the alcohol industry?

The WHO has strongly recommended tax increases as an evidence based and cost-effective policy tool for reducing alcohol consumption and thereby related harm. Alcohol is proven a growing burden globally and an obstacle to development. At a time where governments are warned of the threat to reaching the goal of reducing alcohol harm, the United States needs to strengthen alcohol control instead of undermining it, to protect the American people.