Sri Lanka: Heavy Tobacco Burden as Big Tobacco Profits Rise

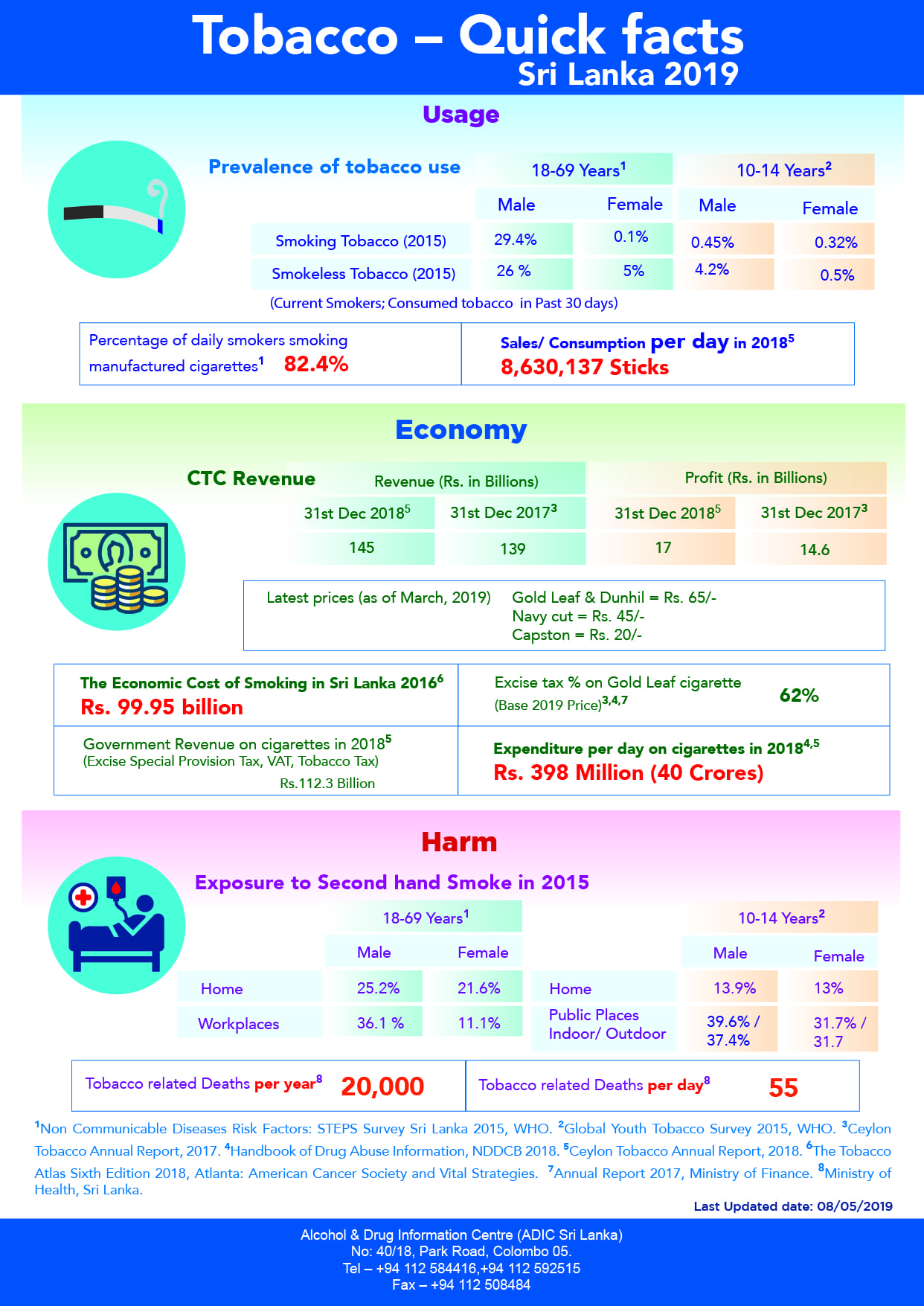

The Alcohol and Drug Information Centre (ADIC) – Sri Lanka recently published an analysis of tobacco use, and the health and economic costs of tobacco to the country.

As reported, the majority of tobacco smokers in Sri Lanka are males. Every day over 8 million cigarettes are consumed within the country. 82.4% of the smokers, smoke manufactured cigarettes.

In Sri Lanka tobacco causes,

- 20,000 deaths per year,

- 55 deaths every day,

- Over 20% of adults and over 13% of children between 10 to 14 years are exposed to second hand smoke at home,

- In the workplace, more than a third (36.1%) of working men are exposed to second hand smoke,

- Over 30% of children between 10 to 14 years are exposed to harm from second hand smoke in public places.

Sri Lankans spend LKR 398 million (US$ 2 million +) on cigarettes per day. The total economic cost of cigarettes to the country is LKR 99.5 billion (US$ 500 million +).

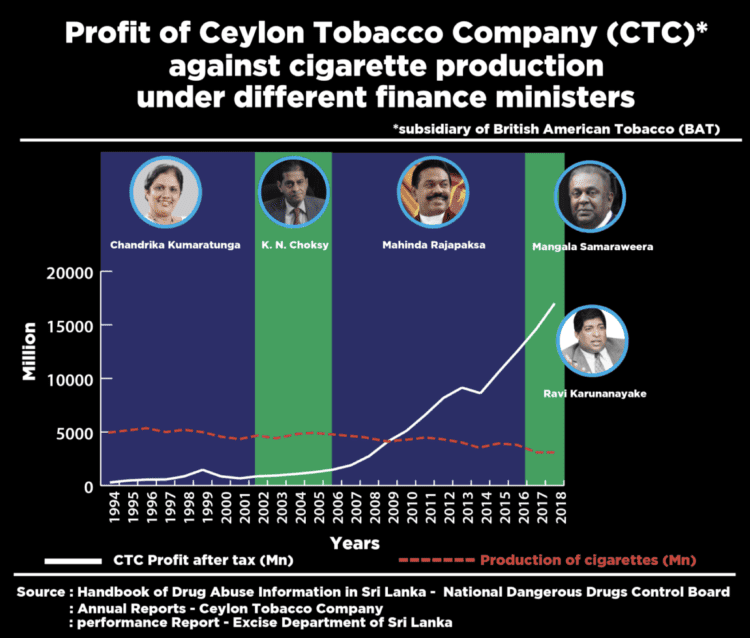

Big Tobacco profits while the country incurs loss

The multinational tobacco company British American Tobacco (BAT) owns 84.13% shares of Ceylon Tobacco Company (CTC). Which places CTC in the holds of the foreign company BAT.

Tobacco use in Sri Lanka has been consistently declining over the years. This fact is backed by scientific evidence from the Alcohol and Drug Information Centre and other scientific bodies in the country. It is further evident through analysis of CTC sales reports.

Even though cigarette sales in Sri Lanka have been declining, the profit of CTC has been increasing disproportionately over the years.

As ADIC – Sri Lanka reports in a recent press release the reason for disproportionate profit increases of CTC when cigarette use is decreasing is due to irrational tobacco taxation. Therefore, when the government taxes tobacco, the tobacco industry earns an unusually high profit.

The government sets only the tax portion of the cigarette price while the final price is decided by the tobacco industry. Thus, it is the government’s responsibility to tax cigarettes to the highest possible amount of the product. In the 2019 budget, the government placed only a 12% tax increase on cigarettes. Due to this increase a Gold Leaf cigarette stick price increased by 5.33 Rupees.

The tobacco industry who understood this price increase will not affect the industry added 4.65 Rupees to the price of a stick. Therefore, the price of one Gold Leaf cigarette increased by 10 Rupees. Due to the added 4.65 Rupees by the tobacco industry the company is able to earn about 12 Billion rupees more in profits per year.

The loss incurred to the country, over the past 5 years, due to these irrational and ineffective tax policies is about 100 Billion Rupees. That is a 100 Billion Rupees lost which could have been invested in development projects. Evidently the ineffective tax policies on tobacco is an obstacle to the development of the country.