Kenya: Alcohol, Tobacco Tax Increase for UHC

Kenya will see an increase of alcohol and tobacco taxation as part of the effort to achieve universal health coverage (UHC). The Kenyan government is set to raise excise duties on cigarettes, wines and liquor by fifteen per cent in part of newly proposed tax measures aimed at mobilizing resources for the Sh 3.02 trillion 2019-2020 budget.

Treasury Cabinet Secretary Henry Rotich said a 750 ml wine bottle will cost Sh 18 above the current rate, with cigarette costs set to rise by Sh 8.

Excise duty on a 750 ml wine bottle will be Sh 136. The duty of a bottle of whisky will go up by Sh 24 to Sh 182 for a 750 ml bottle while a packet of cigarettes will go up to Sh 61,” Treasury Cabinet Secretary Henry Rotich said.

Majority of Kenyans support tax increase

Capital Business reports poll findings that a majority of Kenyans agree with the government’s decision to increase the excise duty on tobacco and alcohol. People also proposed the government should continue increasing taxes for Kenyans to shift their focus on lifetime investments.

Your child cannot miss school because you use your money to buy alcohol and smoke cigar, actually the government should continue doing so that people learn how to invest on lifetime programs,” said John Wamalwa a matatu tout.

Peter Wambua, a bus driver, said per Capital Business:

If this will helps Kenyans make sober decisions then the government should continue adding taxes…”

Tobacco, Alcohol Tax to help reach the Big 4 Agenda

Ministries under which the Big Four Agenda will be executed are among key beneficiaries of the new budget with priority areas listed in the development blueprint set to be funded to the tune of Sh 450 billion according to the spending plan outlined by Rotich when he presented the budget at the National Assembly.

The Big 4 Agenda comprises massive efforts on the areas of agriculture, manufacturing, universal health and affordable housing – driven by governments investments.

Recently, the Global Task Force for Fiscal Policy released its first report about showing the efficacy of health promotion taxation, such as alcohol tax, to reduce health harm, promote health and raise domestic resources. The Task Force suggested to increase taxes high enough to bring up the price by 50% on alcohol and tobacco as well as sugary drinks.

An analysis conducted for the Task Force estimated that over 50 million premature deaths could be prevented if countries implemented excise tax increases large enough to raise product prices of tobacco, alcohol and sugary beverages by 50%over the next 50 years.

The analysis further found the impact of these taxes, projected to yield over US$20 trillion in revenue, would be highest in low- and middle-income countries, where consumption and associated healthcare costs and productivity losses are growing.

Alcohol taxation helps achieve multiple SDGs

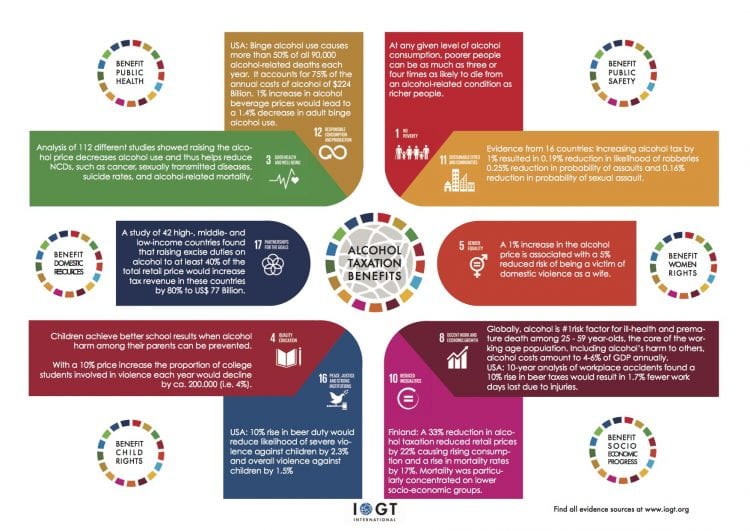

Providing a thorough overview of the evidence, IOGT International has previously visualized in an innovative way how alcohol taxation helps reach at least 10 of the 17 Sustainable Development Goals.

The evidence from this resource shows that the Kenyan government is on the right track, implementing a scientifically proven best by measure. Implementing alcohol taxation measures reaps a triple positive effect:

Domestic resource mobilization

Generate government revenue for nancing development and health promotion

Easing the public health and sustainable development burden

Reduce alcohol-related harms and alcohol’s overall public health, social and economic burden

Prevention of initiation of alcohol use

Maintain high-levels of alcohol abstention rates in low- and middle income countries

—