South Africa: Turf War Between Beer Giants

Heineken is gearing up to increase their share and loosen AB InBev’s grip of the South African Beer market in an ongoing turf war between the multinational beer giants.

AB InBev currently dominates the South African beer market accounting for 88% of South Africa’s beer volumes and 86% of beer value.

AB InBev, the world’s largest beer producer, became the dominant brewer in South Africa when it purchased SABMiller in 2016 in a corporate mega-merger. Since the takeover, AB InBev has overhauled its portfolio and increased distribution of non-SAB brands such as Budweiser and Corona. Sales in South Africa, and the wider African beer market, was a key reason for the SABMiller deal.

Beer giants at war for market domination

To compete with AB InBev, Heineken, the second largest beer producer in the world, is gearing up. Recently Heineken invested in its Sedibeng brewery near Johannesburg.

This investment means an aggressive push to increase Heineken beer consumption. The aim is to hit annual capacity of 7 million hectolitres in SouthAfrica. Heineken is also expanding its South African beer portfolio with the addition of low- and no-alcohol brands including Heineken 0.0, Windhoek Lite, Amstel Radler.

South Africa is not the only country in which the two beer giants are waging war. In March, Heineken opened a US$100m brewery in Mozambique, where AB InBev controls 99% of the beer market through the Cervejas De Moçambique unit, also inherited from SABMiller.

There are numerous other examples of the beer giants’ aggressive push for increasing beer sales and relentless competition among themselves. The countries and markets are:

- Vietnam,

- Ivory Coast,

- Rwanda,

- Myanmar,

- Thailand and Asia, as well as

- the EU.

Vietnam, Thailand, Myanmar and other Asian countries are key to the growth prospects of Big Beer. African countries, like South Africa, are emerging markets with their youthful population are supposed to become the bedrock of windfall profits for Big Alcohol, as nations where the majority of people is not using alcohol.

To convert people in African and Asian countries to alcohol consumption, the beer wars are fueled by a whole host of deeply unethical practices and tactics:

- Collaboration with military regimes,

- Price fixing schemes to exclude smaller beer makers,

- Aggressive alcohol marketing,

- Destroying, derailing and undermining evidence-based alcohol policy regulations, and

- Selling ultra-cheap beer, as in Rwanda, to hook people on the product.

Alcohol burden in South Africa

The damage from the beer war is felt by South Africans, who suffer one of the heaviest alcohol burdens in the African region as well as the world.

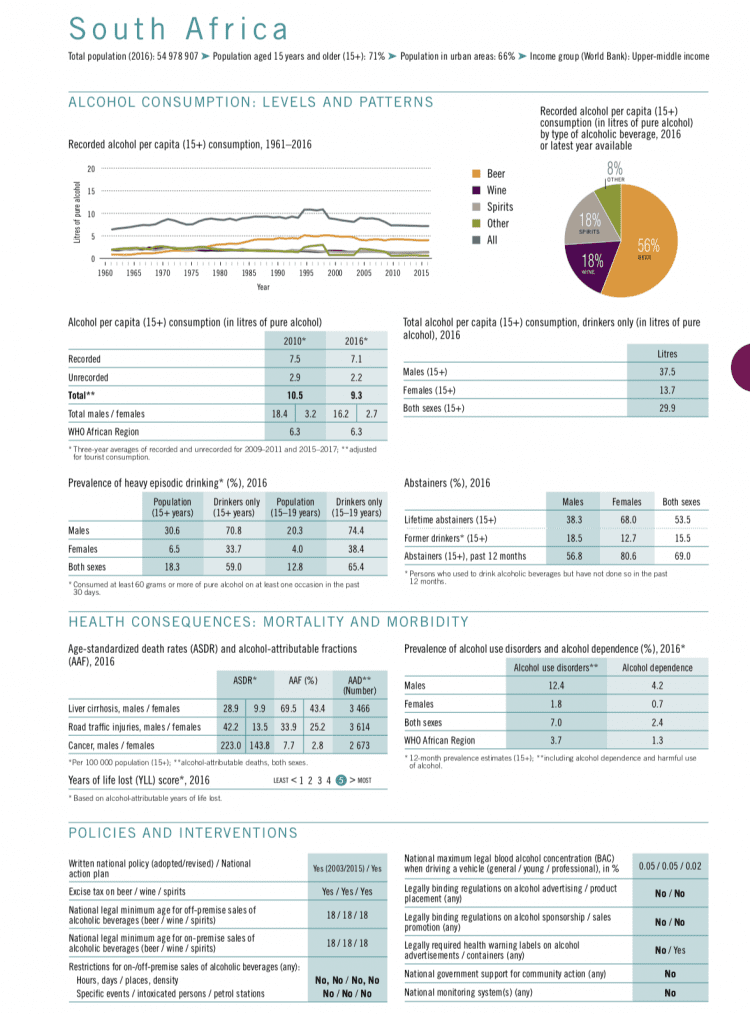

- South Africa’s alcohol using population consumes 29.9 litres of pure alcohol, per capita, annually. This is the fifth highest consumption rate in the world.

- Beer accounts for 56% of the alcohol consumed in the country.

- 59% of the alcohol users binge on the substance, meaning they consume 60 grams or more of pure alcohol on at least one occasion over a 30-day period.

South Africa has one of the highest years of life lost due to alcohol scores in the world. Annually alcohol causes,

- 3400+ Liver Cirrhosis death.

- 3600+ death due to road traffic injury.

- 2600+ death due to cancer.

12.4% men and 7% both men and women in South Africa suffer from alcohol use disorders. A further 2.4% of the population is dependent on alcohol. All these statistics are above the average of the WHO African region.

Heineken in Africa

Heineken’s burden in Africa doesn’t stop at the negative impact on public health. Journalist Olivier van Beemen exposes compelling evidence and stories of the unethical practices of the Dutch beer giant Heineken in the book “Heineken in Africa”.

https://movendi.ngo/press-release/not-a-love-story-heineken-in-africa/

Among the grave violations committed by Heineken in the African region are the following (and more):

- Support for apartheid

- Complicity in genocide

- Tax avoidance

- Aggressive political lobbying to obstruct, derail and undermine public health policy making

- Unethical alcohol marketing, like beer promotion in schools

- Exploitation of young women

- Sexual abuse

Heineken’s disregard for human life and ethics are obvious. Their only priority is profit, over everything else. Importantly, the book details Heineken’s practices with profound evidence but it stands to assume that other beer giants and multinational corporations are likely employing similar tactics and business practices.

—

For further reading:

Vietnam: Big Alcohol Lobby Destroys Alcohol Law

New concerns have emerged about unethical lobbying practices of the alcohol industry. There are reports that some lawmakers had traveled abroad at the invitation of alcohol companies before the bill came up for discussion. And the alcohol industry appears to be successful in these aggressive and unethical lobbying efforts, as provision after provision is deleted from the draft alcohol law that is currently being discussed in the National Assembly.

Vietnam, Asia’s third-largest beer consumer after China and Japan, has seen beer volumes climb by an average 6.6% for the last six years compared to an increase of “just” 0.2% for consumption globally.

Global Beer Giant Kirin Pays Myanmar Military Amid Ethnic Cleansing Of Rohingya

Amnesty International has called for an urgent investigation by Japanese authorities into payments that a subsidiary of the multinational brewing giant Kirin made to Myanmar’s military and authorities at the height of an ethnic cleansing campaign against the Rohingya population in the fall of 2017.

Asia: Alarming Rise in Alcohol Use

A new landmark scientific study shows that alcohol use is rising across much of the Asia region. Even heavy episodic (binge) alcohol use has increased significantly in China, Thailand, Timor Leste and Vietnam, according to new research.

Ivory Coast: Beer Marketing War Rages

A raging beer marketing war in Ivory Coast between Heineken-owned Brassivoire and Castel-owned Solibra is putting children and youth in harms way.

Rwanda: Heineken Sells Beer Below $1

In a move designed to reduce retail prices and boost sales in Rwanda, East Africa and across the African continent, Heineken is starting local production sites. Local production is expected to reduce retail prices by a fifth, according to the beer giant. The price per bottle of Heineken is expected to drop to 800 francs ($0.9231) from 1,000 francs, as soon as local production commences, reports CGTN Africa.

EU: AB InBev Fined For Trade Violations

The European Commission has fined beer giant AB InBev for trade violations. The world’s largest beer maker was fined €200.4 million for price fixing by hindering cheaper imports of its Jupiler beer from the Netherlands into Belgium.